What We Do

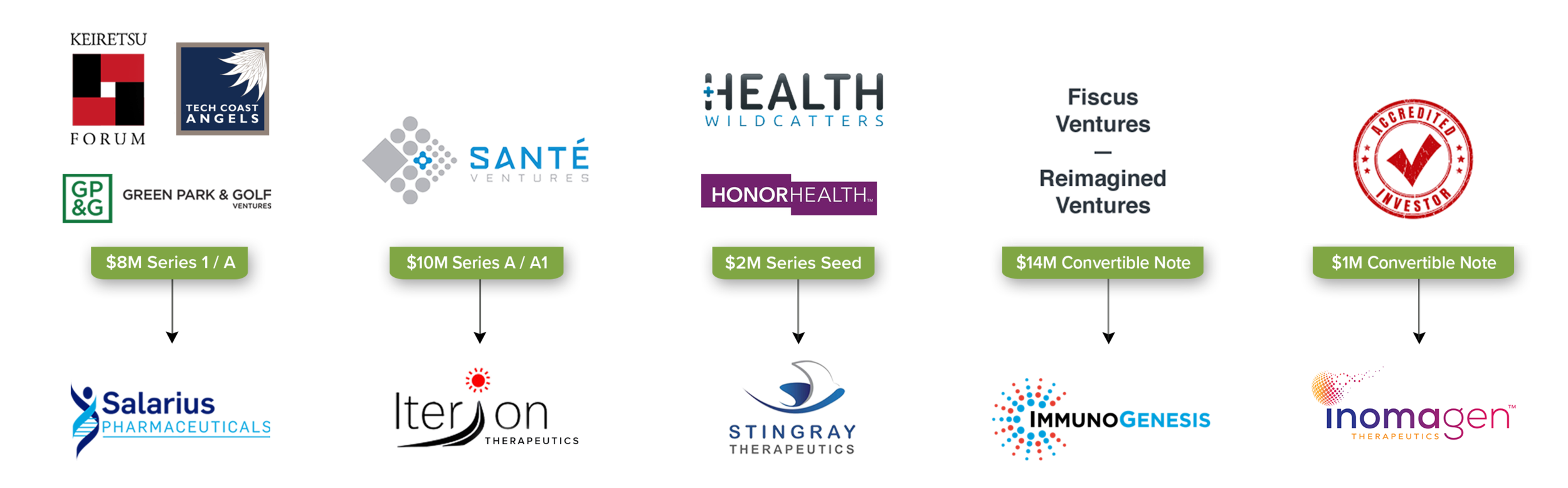

- SJA exceeds client financing objectives by leveraging its extensive network of institutional investors, angel group syndicates, and alternative capital sources (including accredited investors and family offices) to finance early- to mid-stage biotech companies through key value inflection points.

- We are effective at negotiating and closing Series and convertible preferred rounds with institutional capital sources (venture capital, crossover funds), and at identifying and securing commitments from Lead Investors—often pivotal in attracting syndicate participation.

Extensive Investor Network

- Accredited / high-net-worth investors

- Family offices

- Institutional investors (e.g. Venture Capital)

- Cross-over (SPAC / PIPES) / hedge funds